How Home Protection Insurance can Save You Time, Stress, and Money.

Not known Facts About Home Protection Insurance

Table of ContentsThe Definitive Guide for Home Protection InsuranceThe Of Home Protection InsuranceThe Buzz on Home Protection InsuranceThe Buzz on Home Protection InsuranceWhat Does Home Protection Insurance Mean?The Definitive Guide to Home Protection InsuranceGetting My Home Protection Insurance To WorkTop Guidelines Of Home Protection Insurance

TGS Insurance gives house insurance coverage policies that assist you remain shielded for less. By going shopping through over 35 top-rated suppliers, we can find the ideal protection for the least expensive price that fits your demands.

Fascination About Home Protection Insurance

She has actually been composing for TGS Insurance coverage for three years and also makes every effort to make every piece of content she works with informative and also simple to check out. In her spare time, she appreciates cooking and also investing time with her household.

Having a home can be a high-risk venture, taking into consideration all the potential threats. From robbers and hail storm storms to a heater that unexpectedly breaks down in the center of winter, there's a whole lot that can happen to your residence. Luckily, you have options when you require a financial safeguard.

Not known Details About Home Protection Insurance

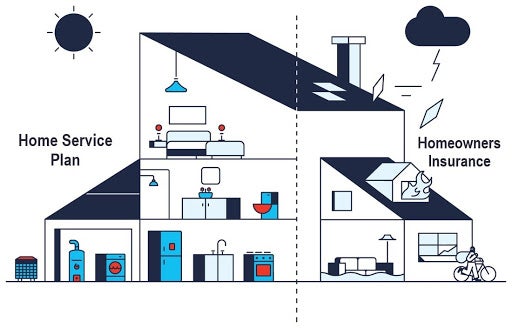

It's important to understand the differences between them as well as when it makes sense to select both kinds of plans (home protection insurance). What does home owners insurance cover? A. As an example, fire, burglary, lots of kinds of all-natural calamities, disaster, criminal damage, crashes and other risks are normally consisted of in a homeowners insurance plan.

Instead, you're billed a or more. Homeowners warranty protection is purely and not required by your mortgage lender or anybody else. What's the difference? Property owners insurance is implied to safeguard insurance policy holders against damages to their personal effects and also damages to the residence's framework, while house warranties cover mechanical equipment that requires to be repaired or replaced.

How Home Protection Insurance can Save You Time, Stress, and Money.

Several property owners locate protection voids in their home owners insurance plan, so you may take into consideration obtaining both sorts of coverage. Claim a pipe bursts in your house. Your residence warranty would cover the expenses to fix the pipeline yet not damages caused by the leak. If the leakage was significant, your home owners insurance policy would certainly cover the damage.

A residence service warranty can supply that peace of mind and protection.

Home Protection Insurance - The Facts

We wish we can cover whatever in a home, for the house guarantee from this source market to be reasonable to all its agreement owners, protection standards have to be followed constantly, simply like house owners insurance policy.

The 2-Minute Rule for Home Protection Insurance

Review the residence guarantee contract with your customer Get an example contract from the residence warranty firm your seller picks. Make it clear that a house warranty covers house systems and devices that have fallen short from common wear and also tear - home protection insurance.

Home Protection Insurance for Dummies

The majority of home guarantees have 24/7 cases assistance and will send a certified solution professional to their property to Recommended Site make a repair service or substitute for a $50 to $60 solution call fee. Home guarantees as well as residence insurance are not the exact same Residence insurance policy is a requirement with a home mortgage, and it covers damage from natural catastrophes, floods and also robbery.

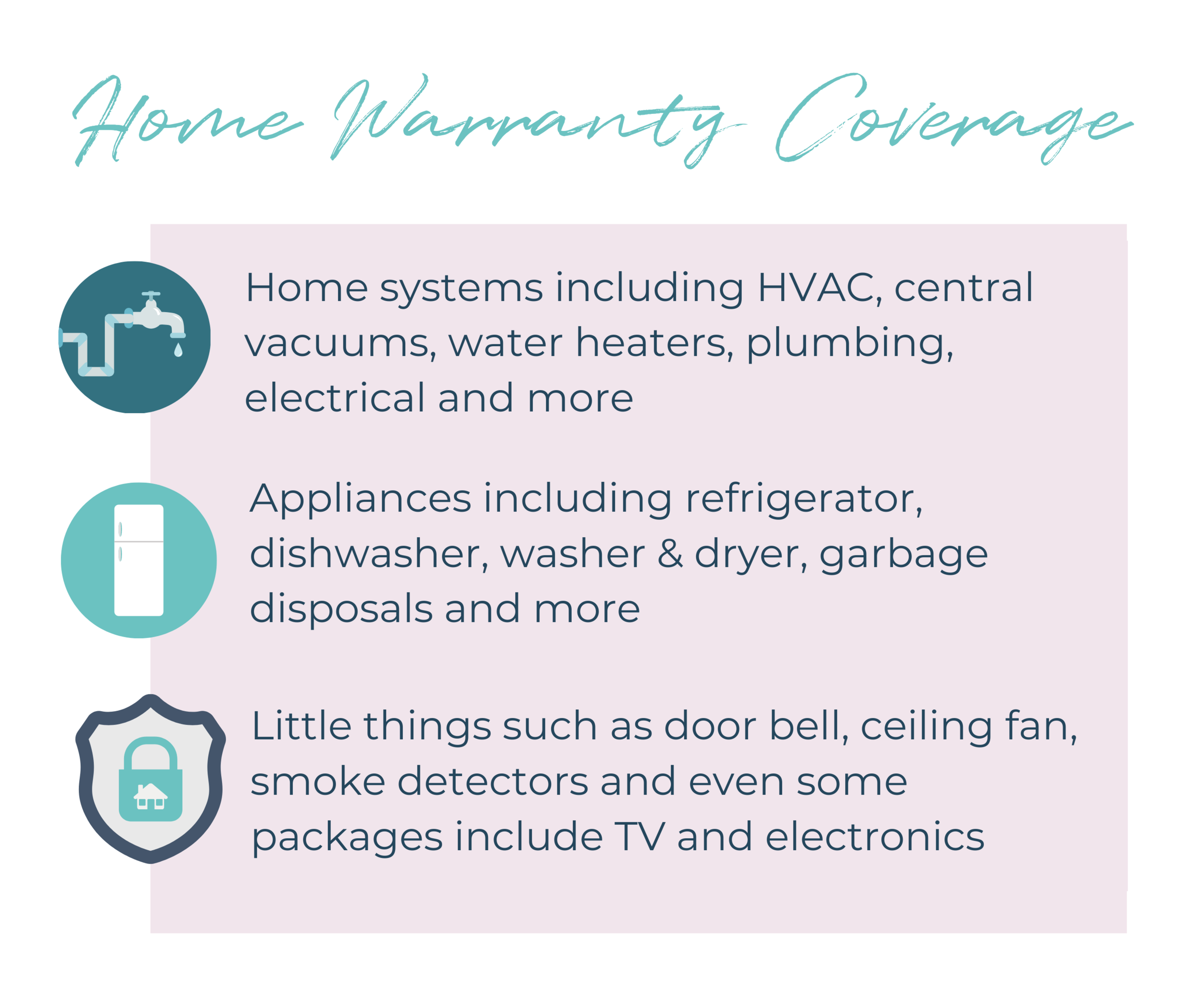

All home guarantee firms have various degrees of coverage, which generally depend upon the cost of the service warranty. The majority of protection plans cover: Home heating systems Cooling look at this now systems Pipes systems Electrical systems Devices such as: Dishwasher Waste disposal Stove Home guarantee business have limits and also exemptions Although house warranties cover most systems and also home appliances, they sometimes have restrictions as well as exemptions on specific things.

The Definitive Guide to Home Protection Insurance

Depending on the age of a system or gadget, components will simply quit functioning. Motors, followers, electrical elements as well as more will certainly go out with age. As long as a reasonable initiative has been made to maintain the system as well as it was functioning when the property owner acquired the residence, when it stops working, the residence warranty will cover any type of fixings and replacements needed.

An educated client is a pleased client Utilizing these suggestions, your client will know what their guarantee does as well as doesn't cover. They won't be blindsided by a costly repair or replacement that wasn't covered in the agreement, and also you will maintain a good working connection with them, as their realty agent.